The Effect of CEO Entrenchment on the Relationship between Corporate Governance and Firm Performance

Duangnapa Sukhahuta

Faculty of Business Administration, Maejo University, Thailand, E-mail: duangnapa@live.com

Abstract

The purpose of this study is to study the effect of Thai CEO entrenchment on the relationship between corporate governance and firm performance. This study collects the sample from the companies listed on the stock markets in Thailand. The period collecting is 5 years, from 2012 to 2016. Thai business culture is different from western country cultures. Thai people are generally very relaxed and easy-going and will rarely take offence. Hierarchy is a common thing for Thai people. Thus, a CEO who has the highest rank in the companies will be respected by all staffs in that firm. With the highest position, the CEO can use his or her power to interfere the corporate governance system. So CEO has more chances to take private benefits. As a result, the firm cannot achieve the best performance. This study uses the Multiple Regression Analysis to test the relationship between corporate governance and firm performance. In addition, this study tests the moderating effect of CEO entrenchment on the relationship between corporate governance and firm performance.

The empirical study found that corporate governance has a statistical significance effect on firm performance. Further from past empirical studies, this study is to test the moderating effect using CEO entrenchment. This study found that the interaction between CEO entrenchment and corporate governance is significantly negative to the firm performance at 0.01 levels. Therefore, CEO entrenchment is a moderator that affects to the relationship between corporate governance and firm performance. Thus, it can be concluded that CEO entrenchment causing from agency problem affects the corporate governance of the firm. As the result, the firm performance becomes worse.

Keywords- Corporate governance; Firm performance; CEO entrenchment

1. Introduction

The Asian financial crisis began in July 199 and it is started in Thailand. This crisis is caused from the financial collapse known as Tom Yum Goong crisis. After this crisis, corporate governance become an important issue because it enhances efficiency, transparency and accountability of a firm. Thailand was never colonized, the business culture has been influenced to a lesser extent by western culture. Thai society count for hierarchies. Individual status is always taken into consideration in social and business interactions. CEOs have the highest management position will be on the top of the firm hierarchies. Thus, CEOs will have high power and it will be more easily to take private benefits from the firm. According to agency theory, CEOs are self-interested and have own goals that diverge from those of shareholders (Jensen and Meckling, 1976). Thus, CEOs will engage in maximizing their own wealth instead of maximizing shareholders’ wealth. This study offers two contributions. First, it tests the moderation effect using CEO entrancement as a moderator to the link between corporate governance and firm performance. The results can be used to confirm the Agency theory. Second, our findings offer practical implications for organizations such as the Securities and Exchange Commission Thailand (SEC) that prepares CG guidelines for the firms listed in the stock exchange of Thailand.

2. Literature Review and Hypothesis Development

Agency Theory

One of the well-known financial theories that has been extensively applied in corporate finance is the agency theory. Jensen and Meckling (1976) define the agency relationship as a contract between two parties where one is a principal (shareholder) and the other is an agent (manager) who represents the principal in transactions with a third party. Agency relationships occur when the principals hire the agents to perform some services on the principal's behalf. Principals commonly delegate decision-making authority to the agents.

Coporate governance

Corporate Governance is a managerial principle and it is used to balance the interests of stakeholders and enhance transparency and accountability of for a firm. Corporate governance has been discussed in academic areas since the 1930’s (Lima and Sanvicente, 2013). The Organization of Economic Cooperation and Development (OECD) suggests five major principles of corporate governance which are the rights of shareholders, the equitable treatment of shareholders, the role of stakeholders in corporate governance, disclosure and transparency, and the responsibilities of the board. Also, the globalization of financial markets acts as a key assist in the implementation of codes of CG (Khanna and Palepu, 2004; Brown et al., 2011).

CEO Entrenchment

“Entrenchment is defined as a voluntary of manager to neutralize the control mechanisms which are imposed by the principal; what to allow granting itself more important personal advantages (Walsh and Seward 1990)” cited in cited in Moussa et al (2013). They also explained that if CEOs cannot be easily dismissed by the board of directors, CEO is considered as entrenched (Moussa et al., 2013). .

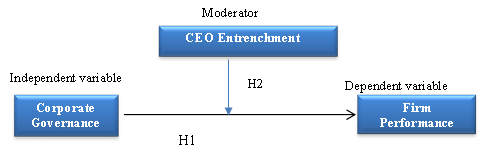

Proposed conceptual model

|

Figure 2.1 Conceptual Framework of the Relationship between Corporate governance and firm performance: the Effect of CEO Entrenchment

Objectives

1. To test the the direct effect of the relationship between Corporate governance and firm performance.

2. To test the CEO entrenchment effect (Moderator effect)

Hypotheses

H1: Corporate governance is positively related to the firm performance.

H2: CEO Entrenchment moderates the relationship between corporate governance is positively related to the firm performance

3. Research Method

Measuring Corporate Governance

Corporate governance, acting as a mechanism, can reduce the agency cost created by CEO entrenchment. Corporate governance device is chosen for this study framework is the corporate governance score from the Thai Institute of Directors (Thai IOD), which is reported in the Corporate Governance Report (CGR) every year.

Measuring Performance

This study measures firm performance using return on assets (ROA). ROA is calculated as income before extraordinary items scaled by total assets of the firm.

Measuring CEO entrenchment

Following Chava et al. (2010) and Kumar and Rabinovitch (2011), this study uses tenure to capture CEO entrenchment by calculating the total number of months that the CEO has served the position.

Multiple Regression Analysis

![]() (1)

(1)

![]() (2)

(2)

Where

The subscripts i and t denote firm and time, respectively

CGit = Corporate governance score/ Institutional ownership

CGit * CENit = Governance score* CEO Entrenchment

ROAit = Return on assets = operating income to total assets

Debtit = Debt-to-Equity is calculated as total debt to total equity.

SIZEit = Firm size (LogMV) is measured as the natural logarithm of the market value

Data Collection and Sample

Sample

This study uses the data of the listed companies on the Stock Exchange of Thailand (SET) and the Market for Alternative Investment (mai). The data covers the period of 2012 to 2016 and is taken from financial statements and annual reports provided by the Stock Exchange Commission (SEC) and the SET. The missing variable in each field is excluded. Finally, we use 1,839 firm-years for this research.

Source of data

The research uses data from four separate sources that are the annual reports, Bloomberg database, and SET Market Analysis and Reporting Tool (SETSMART) on-line service.

Analysis Method

Multiple regression analysis is used to test our hypothesis. The primary objective of this study is to examine the relationship between corporate governance and firm performance. We also include CEO entrenchment in the full model to see if CEO entrenchment changes the relationship between corporate governance and firm performance.

4. Results

Table 4.1 Descriptive Statistics of Variables

|

Variable |

N |

Minimum |

Maximum |

Mean |

Median |

Std. Deviation |

|

ROA |

1839 |

-57.79 |

49.58 |

5.61 |

5.90 |

9.53 |

|

Profit |

1839 |

-292.60 |

356.47 |

6.82 |

6.89 |

29.16 |

|

Debt |

1839 |

0.00 |

134.41 |

23.43 |

20.65 |

21.12 |

|

Size |

1839 |

5.57 |

20.02 |

11.98 |

11.61 |

2.40 |

|

CEN |

1839 |

0.17 |

438.23 |

112.89 |

85.20 |

97.10 |

The descriptive statistics for the variables used in our regression model are presented in Table 4.1. Firm performance (ROA) shows that the mean (median) is 5.61 (5.90) with a minimum of -57.79 and a maximum of 49.58. The mean (median) value for CEO entrenchment (CEN) in our sample is 112.89 (85.20) months.

Table 4.2 Pearson Correlation Matrix of Variables

|

|

ROA |

Profit |

Debt |

Size |

CEN |

CG |

|

|

|

ROA |

1 |

|

||||||

|

Profit |

.582** |

1 |

||||||

|

Debt |

-.252** |

-.035 |

1 |

|||||

|

Size |

.305** |

.254** |

.112** |

1 |

||||

|

CEN |

.083** |

.025 |

.016 |

-.085** |

1 |

|||

|

CG |

.339** |

.228** |

.005 |

.402** |

.021 |

1 |

||

** Correlation is significant at the 0.01 level (2-tailed)

Table 4.2 presents the Pearson correlation matrix between variables. This study performs the Pearson correlation test to gain an insight into the relationship between variables. The results of this correlation also act as a preliminary indication of the multi-collinearity problem. The result shows that ROA is significantly positively correlated with profit, size, CEO entrenchment (CEN), and corporate government (CG). ). In contrast, it shows significantly negatively correlation with debt. In addition, the corporate governance (CG) is significantly positively correlated with almost every variable except debt and CEN.